Calculating depreciation diminishing value

Serve as collateral diminishing the risk of the lender suffering the agency costs of debt like risk shifting. The principle of increasing and diminishing returns is related to the principle of balance.

Working From Home During Covid 19 Tax Deductions Guided Investor

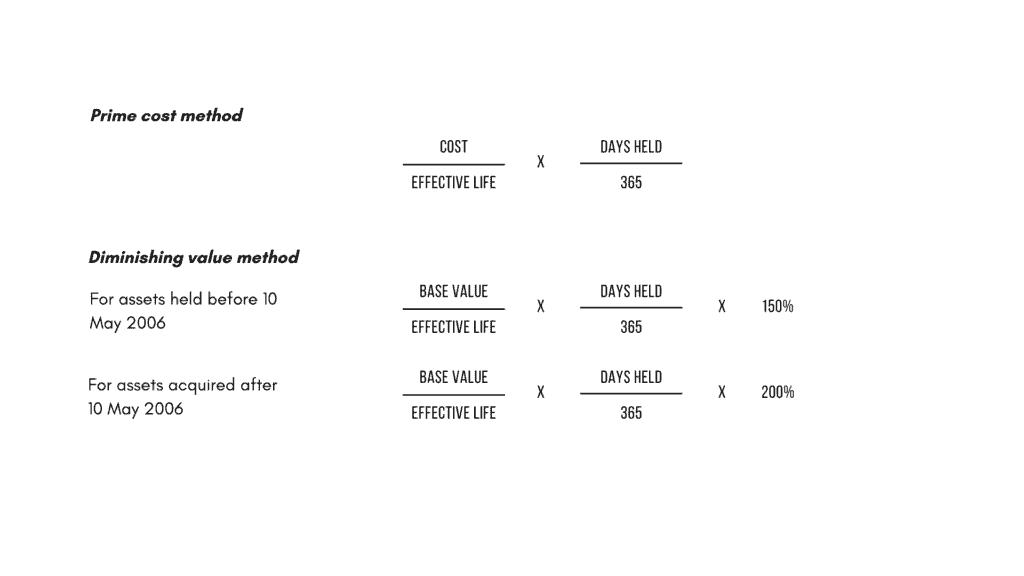

To use this method the following calculation is used.

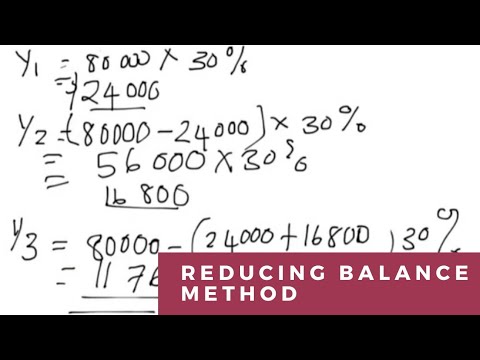

. Declining Balance Method. Net book value - residual value x depreciation factor the depreciation charge per year. You then take the depreciation charge and subtract it from your current book value.

Below is the explanation of the values that are required to add to the calculator for calculation. Double declining depreciation 2 x straight-line depreciation rate x value at the start of the year Example. Diminishing Balance Method.

A company acquires a machine for INR 250000 with an expected useful life of 10 years. Final value residual value - The expected final market value after the useful life of the asset. For entities with.

The original value of the asset plus any additional costs required to get the asset ready for its. Property owners have two ways of calculating depreciation on their assets. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance.

Here is the calculation for three years. Economic value added EVA is the economic profit Economic Profit Economic profit refers to the income acquired after deducting the opportunity and explicit costs from the business revenue ie total income minus overall expenses. To calculate depreciation you can generally use either the prime cost method or the diminishing value method.

Period - The estimated useful life span or life expectancy of an asset. Thus formula for calculating depreciation expense as per this method is as follows. Entities with a 31 March 2020 financial year end and later will need to reflect these changes when calculating deferred tax on buildings.

It is an internal analysis metric used by the organizations along with the accounting profits. This will give you the total depreciation on the machine to date. Depreciation Expense Book value of asset at beginning of the year x Rate of Depreciation100.

Use the following balance formula to calculate the depreciation. Tax depreciation of buildings was originally removed in May 2010 with effect for the 2012 income tax year. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

Assets cost days held 365 100 assets effective life. Improving real estate increases its value up to a point but eventually improvements may offer. The formula for this type of depreciation is as follows.

Calculating machine depreciation is simple. Economic Value Added EVA concept. It is calculated by subtracting accumulated.

It is calculated by dividing the change in the costs by the change in quantity. This will end up calculating your remaining book value. In some cases you must use the same method used by the former holder of the asset for example if you.

The general depreciation rules set the amounts capital allowances that can be claimed based on the assets effective life. Asset value - The original value of the asset for which you are calculating depreciation. Remember to keep an eye on solar tax credit amounts which may change in the coming years.

This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life. After the initial decrease the marginal cost Marginal Cost Marginal cost formula helps in calculating the value of increase or decrease of the total production cost of the company during the period under consideration if there is a change in output by one extra unit. For assets that use a diminishing value method Oracle Assets depreciates the remaining fraction of the assets net book value as of the beginning of the fiscal year.

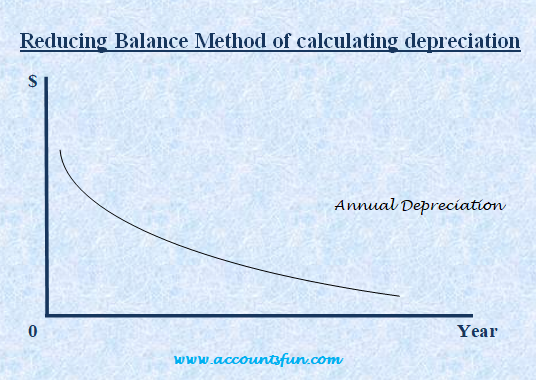

Reducing balance depreciation is also known as declining balance depreciation or diminishing balance depreciation. Multiply the yearly depreciation value that you calculated in the previous step by the number of years the machine has been used. To calculate reducing balance depreciation you will need to know.

The tax depreciation rate will be 15 straight line or 2 diminishing value. How to calculate reducing balance depreciation. By definition depreciation is the diminishing value of an asset over time due to regular wear and tear or obsoletion.

This way calculating. Written-down value is the value of an asset after accounting for depreciation or amortization and it is also called book value or net book value. Try and repeat these steps throughout the assets.

Taxpayers can account for depreciation when they file their annual taxes reducing their tax liability. The salvage value is estimated at INR 25000. Under this method depreciation charge is estimated based on the number of units produced by an.

Units of Production Method. Assets should also retain more value in liquidation. If the asset cost 80000 and has an effective life of five years the claim for the first year will be.

Depreciation expense Book value of the asset at the beginning of the year x Rate of depreciation. Read more yellow line starts to. The cost includes the amount you paid for the asset excluding GST if entitled to claim it as well as any additional amounts paid for transport installation or making it ready to use.

Straight Line Depreciation You May Also Like. If your depreciation method multiplies a flat-rate by the cost Oracle Assets depreciates the assets cost remaining after a partial retirement.

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

How To Use The Excel Ddb Function Exceljet

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Depreciation

Double Declining Balance Depreciation Calculator

Depreciation Rate Calculator Store Save 45 Countylinewild Com

Depreciation Formula Calculate Depreciation Expense

Written Down Value Method Of Depreciation Calculation

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Straight Line Vs Reducing Balance Depreciation Youtube

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

How To Calculate Diminished Value 13 Steps With Pictures

Depreciation Formula Calculate Depreciation Expense

How To Calculate The Diminished Value Of Your Car Yourmechanic Advice